Employee Self-Service overview - Thomson Reuters

The client's employees can then sign in to view, edit, and print their information. This topic explains the process flow for setting up Employee Self-Service for a client's employees.

Employee Self-Service administration - Thomson Reuters

Through Employee Self-Service, your clients' employees can enter time; view check stubs, Forms W-2s, and Forms 1099-MISC/1099-NEC (for independent contractors); and update W-4 …

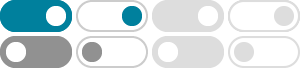

Activate employee portals - Thomson Reuters

This procedure is to be performed by the client's employees. After the employee receives the registration email, they can activate their Employee Self-Service account by doing the following:

Set up employee payroll tax information - Thomson Reuters

Taxes section, you can mark employees as exempt for individual taxes. Follow these steps to set up payroll tax information for an employee.

Use the Employee Earnings view - Thomson Reuters

The Employee Earnings view helps you quickly understand your employees' compensation history. Use it to spot trends, verify payments, or prepare for reviews. The Employee Earnings …

View employee earnings at a glance - Thomson Reuters

The Employee Earnings view provides you with a snapshot view of employees' earnings for the current and prior year. The view includes pay item hours and amounts, deduction and …

Set up employees and payroll items - Thomson Reuters

Set up alternate minimum wage rates for tipped employees Set up and manage independent contractors Set up a non-taxable reimbursement payroll item Set up health savings account …

Tax Pros Urge Caution in 2025 Overtime Reporting

Nov 14, 2025 · Despite the IRS’ encouragement, Hevener strongly advises against reporting the qualified overtime amount on employees’ Forms W-2 for 2025. She warned of litigation risks …

Statutory employee: Overview and FAQs | Thomson Reuters

Apr 30, 2025 · What is a statutory non-employee? For tax purposes, statutory non-employees are like independent contractors, but under the common law test, they may qualify as employees.

What Employees Are Counted for Purposes of COBRA’s Small …

Nov 19, 2025 · Only common-law employees are counted as “employees” for purposes of COBRA’s small employer exception. Do not count self-employed individuals, independent …